All You Need to Understand About the Foreign Earned Income Exclusion and Its Link to the Common Reduction

The Foreign Earned Income Exemption (FEIE) offers an essential possibility for U.S. citizens and resident aliens working abroad to reduce their gross income. Recognizing the eligibility criteria and declaring procedure is crucial. Nonetheless, the interaction in between the FEIE and the conventional reduction can make complex tax approach. Mistakes in maneuvering these rules can lead to missed out on advantages. Discovering these aspects discloses crucial details for reliable tax obligation preparation and making best use of financial advantages.

Understanding the Foreign Earned Income Exclusion (FEIE)

The International Earned Earnings Exclusion (FEIE) works as an essential tax arrangement for U.S. residents and resident aliens who work abroad, permitting them to leave out a significant part of their foreign-earned revenue from U.S. government taxation. This provision is important for people living outside the United States, as it aids minimize the financial concern of double taxes on earnings made in international countries. By using the FEIE, qualified taxpayers can lower their gross income substantially, advertising economic stability while living and working overseas. The exclusion quantity is readjusted each year for inflation, ensuring it shows present economic conditions. The FEIE is particularly helpful for those in areas with a higher price of living, as it enables them to preserve even more of their profits. Recognizing the auto mechanics and effects of the FEIE encourages migrants to make enlightened economic decisions and maximize their tax obligation scenarios while residing abroad.

Qualification Demands for the FEIE

To get approved for the Foreign Earned Income Exemption, people should meet certain qualification requirements that consist of the Residency Examination and the Physical Presence Test. In addition, employment condition plays a crucial role in determining eligibility for this tax obligation advantage. Comprehending these requirements is necessary for any person looking for to take benefit of the FEIE.

Residency Test Criteria

Figuring out qualification for the Foreign Earned Income Exemption (FEIE) depends upon conference specific residency test requirements. Mostly, people need to develop their tax home in an international country and demonstrate residency via either the authentic residence test or the physical existence test. The bona fide house examination calls for that a taxpayer has actually established a permanent home in an international nation for a nonstop duration that extends a whole tax obligation year. This involves showing intent to make the international place a major home. Furthermore, the taxpayer has to display ties to the international country, such as protecting employment, real estate, or family members links. Fulfilling these residency standards is important for certifying for the FEIE and effectively minimizing tax obligation liabilities on earned earnings abroad.

Physical Presence Test

Fulfilling the residency criteria can also be achieved through the physical presence test, which uses an alternative path for getting approved for the Foreign Earned Earnings Exemption (FEIE) To satisfy this test, a private have to be physically present in a foreign nation for a minimum of 330 complete days during a successive 12-month duration. This need stresses the relevance of actual physical existence, rather than simply preserving a house abroad. The 330 days do not need to be successive, permitting flexibility in travel setups. This test is particularly useful for U.S. citizens or homeowners working overseas, as it allows them to exclude a significant section of their foreign made revenue from U. FEIE Standard Deduction.S. taxes, thereby lowering their general tax obligation responsibility

Employment Standing Requirements

Eligibility for the Foreign Earned Income Exemption (FEIE) hinges on details work status demands that individuals have to fulfill. To qualify, taxpayers have to show that their earnings is stemmed from foreign resources, usually with work or self-employment. They need to be either an U.S. citizen or a resident alien and preserve a tax obligation home in a foreign country. In addition, people must fulfill either the Physical Existence Test or the Authentic Home Test to establish their foreign status. Freelance people need to report their internet profits, guaranteeing they do not go beyond the recognized exclusion restrictions. It's important for applicants to preserve proper documents to confirm their cases regarding work status and international revenue throughout the tax year.

Just how to Claim the FEIE

Qualification Demands Explained

For people seeking to benefit from the Foreign Earned Income Exclusion (FEIE), understanding the eligibility demands is crucial. To qualify, one need to satisfy two key tests: the bona fide home test or the physical presence test. The bona fide house test applies to those that have actually established a permanent home in a foreign nation for a nonstop period, typically a year or even more. Conversely, the physical existence test requires individuals to be literally existing in an international nation for at least 330 More Help days throughout a 12-month period. FEIE Standard Deduction. Furthermore, only earned income from international resources gets exemption. Meeting these criteria is important for taxpayers desiring to lower their taxed revenue while staying abroad

Needed Tax Return

Just how can one efficiently claim the Foreign Earned Revenue Exemption (FEIE)? To do so, particular tax return have to be used. The primary kind needed is IRS Form 2555, which enables taxpayers to report international gained income and declare the exemption. This form needs thorough info concerning the individual's international residency and the income made while living abroad. In addition, if claiming the exclusion for housing prices, Kind 2555-EZ might be used for simplicity, provided certain requirements click now are fulfilled. It is essential to assure that all required areas of the kinds are finished properly to stay clear of delays or concerns with the IRS. Comprehending these forms is essential for taking full advantage of the advantages of the FEIE.

Declaring Process Actions

Asserting the Foreign Earned Earnings Exemption (FEIE) includes a collection of clear and well organized steps. Individuals must determine their qualification, validating they satisfy the physical existence or bona fide residence examinations. Next, they must finish internal revenue service Type 2555, describing earnings earned abroad and any applicable exclusions. It is vital to collect sustaining documentation, such as international income tax return and proof of home (FEIE Standard Deduction). After completing the kind, taxpayers ought to affix it to their yearly income tax return, commonly Type 1040. Filing online can enhance this process, yet making certain exact details is essential. People must maintain copies of all submitted forms and supporting records for future reference in situation of audits or queries from the Internal revenue service.

The Requirement Deduction: A Summary

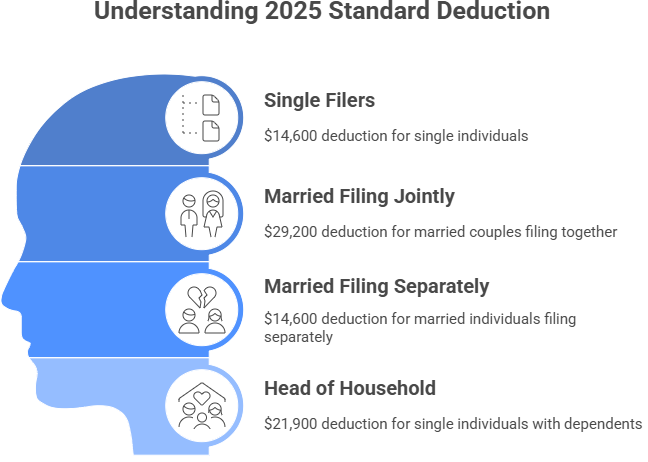

The typical deduction acts as a crucial tax obligation benefit that simplifies the declaring procedure for numerous people and households. This reduction permits taxpayers to reduce their taxed revenue without the demand to make a list of deductions, making it an attractive alternative for those with straightforward financial scenarios. For the tax obligation year, the common deduction amount differs based upon declaring standing, with various thresholds for solitary filers, couples submitting jointly, and heads of household.

The conventional reduction is readjusted each year for inflation, guaranteeing its importance with time. Taxpayers who certify can choose in between the basic reduction and itemizing their reductions, typically deciding for the greater advantage. By offering a standard reduction, the basic reduction sustains taxpayers in decreasing their total tax obligation responsibility, therefore improving their monetary setting. Recognizing the common reduction is crucial for efficient tax planning and taking full advantage of possible cost savings for individuals and family members alike.

Interaction Between FEIE and Typical Reduction

While both the Foreign Earned Income Exclusion (FEIE) and the common reduction serve to minimize taxed earnings, their communication can significantly influence a taxpayer's overall tax liability. Taxpayers that receive the FEIE can omit a considerable quantity of their foreign-earned income, which may affect their eligibility for the basic deduction. Especially, if a taxpayer's international revenue is totally excluded under the FEIE, their taxed income may drop below the limit required to claim the standard reduction.

Nonetheless, it is vital to keep in mind that taxpayers can not double-dip; they can not make use of the exact same revenue to claim both the FEIE and the standard deduction. This means that cautious consideration is needed when figuring out the most effective approach for tax obligation reduction. Eventually, recognizing how these 2 arrangements interact allows taxpayers to make educated decisions, guaranteeing they maximize their tax benefits while continuing to be certified with internal revenue service regulations.

Tax Advantages of Using the FEIE

Utilizing the Foreign additional hints Earned Revenue Exclusion (FEIE) can offer notable tax obligation advantages for united state residents and resident aliens living and working abroad. This exemption allows eligible individuals to leave out a particular quantity of foreign-earned revenue from their taxable revenue, which can lead to significant tax cost savings. For the tax year 2023, the exclusion amount depends on $120,000, significantly reducing the gross income reported to the IRS.

In addition, the FEIE can help prevent double taxation, as international taxes paid on this revenue may also be qualified for reductions or debts. By tactically making use of the FEIE, taxpayers can maintain even more of their revenue, enabling for improved monetary security. Furthermore, the FEIE can be beneficial for those who get the bona fide home test or physical existence examination, supplying adaptability in handling their tax obligation commitments while living overseas. Overall, the FEIE is a beneficial device for migrants to optimize their economic sources.

Common Blunders to Stay Clear Of With FEIE and Typical Reduction

What pitfalls should taxpayers recognize when claiming the Foreign Earned Earnings Exemption (FEIE) together with the basic deduction? One common error is presuming that both advantages can be asserted concurrently. Taxpayers must comprehend that the FEIE has to be asserted before the typical deduction, as the exemption basically lowers gross income. Falling short to fulfill the residency or physical presence examinations can additionally bring about ineligibility for the FEIE, causing unforeseen tax obligation responsibilities.

In addition, some taxpayers forget the need of appropriate paperwork, such as preserving documents of foreign earnings and traveling days. An additional constant error is overlooking the exemption quantity, potentially because of inaccurate forms or false impression of tax obligation policies. Ultimately, people need to remember that claiming the FEIE could affect eligibility for sure tax obligation credit reports, which can complicate their overall tax scenario. Understanding of these risks can aid taxpayers browse the intricacies of global taxation better.

Often Asked Questions

Can I Claim FEIE if I Live Abroad Part-Time?

Yes, an individual can declare the Foreign Earned Earnings Exemption if they live abroad part-time, provided they satisfy the needed requirements, such as the physical visibility or bona fide residence tests described by the internal revenue service.

Does FEIE Impact My State Tax Obligations?

The Foreign Earned Revenue Exemption (FEIE) does not directly impact state tax obligations. States have varying regulations regarding earnings earned abroad, so individuals need to consult their specific state tax regulations for precise assistance.

Exist Any Type Of Expiration Dates for FEIE Claims?

Foreign Earned Revenue Exclusion (FEIE) claims do not have expiration days; however, they should be claimed yearly on tax returns. Failure to case in a provided year may lead to lost exclusion advantages for that year.

Exactly How Does FEIE Influence My Social Safety Advantages?

The Foreign Earned Earnings Exclusion (FEIE) does not directly impact Social Safety advantages, as these benefits are based on life time revenues. Nevertheless, left out earnings may lower total earnings, possibly affecting future benefit computations.

Can I Revoke My FEIE Case After Filing?

Yes, an individual can withdraw their Foreign Earned Earnings Exemption claim after declaring. This cancellation needs to be sent with the appropriate tax return, and it will certainly influence their tax obligations and potential deductions progressing.

The Foreign Earned Revenue Exclusion (FEIE) provides a vital possibility for U.S. residents and resident aliens working abroad to lower their taxable earnings. Understanding the Foreign Earned Revenue Exclusion (FEIE)

The Foreign Earned International Exclusion RevenueExemption) serves as an essential tax vital for Arrangement citizens united state people aliens who work thatFunction allowing them to exclude a leave out portion considerable part foreign-earned income from Revenue federal taxationGovernment While both the Foreign Earned Revenue Exemption (FEIE) and the standard reduction serve to lower taxable income, their communication can greatly affect a taxpayer's overall tax obligation liability. Using the Foreign Earned Earnings Exclusion (FEIE) can offer noteworthy tax benefits for U.S. residents and resident aliens living and functioning abroad. Foreign Earned Income Exemption (FEIE) cases do not have expiry dates; nevertheless, they need to be claimed every year on tax obligation returns.